figma.com

About

The Client

One of Australia’s largest banks Westpac.

What was the project about

This project sat within the consumer lending and property ownership space and aimed to make buying, owning, or investing in property simpler and more transparent digital experience for customers

What did I focus on?

The team had a view that digitising the process would deliver value. Specifically my role was to shape what that looked like for both single and joint applicants and for both investors and owner-occupiers.

PRODUCT

Westpac

ROLE

Senior product designer

Contributions

User testing, Wireframes, Prototyping, Interface & Interaction Design

DATE

October 2015

The product

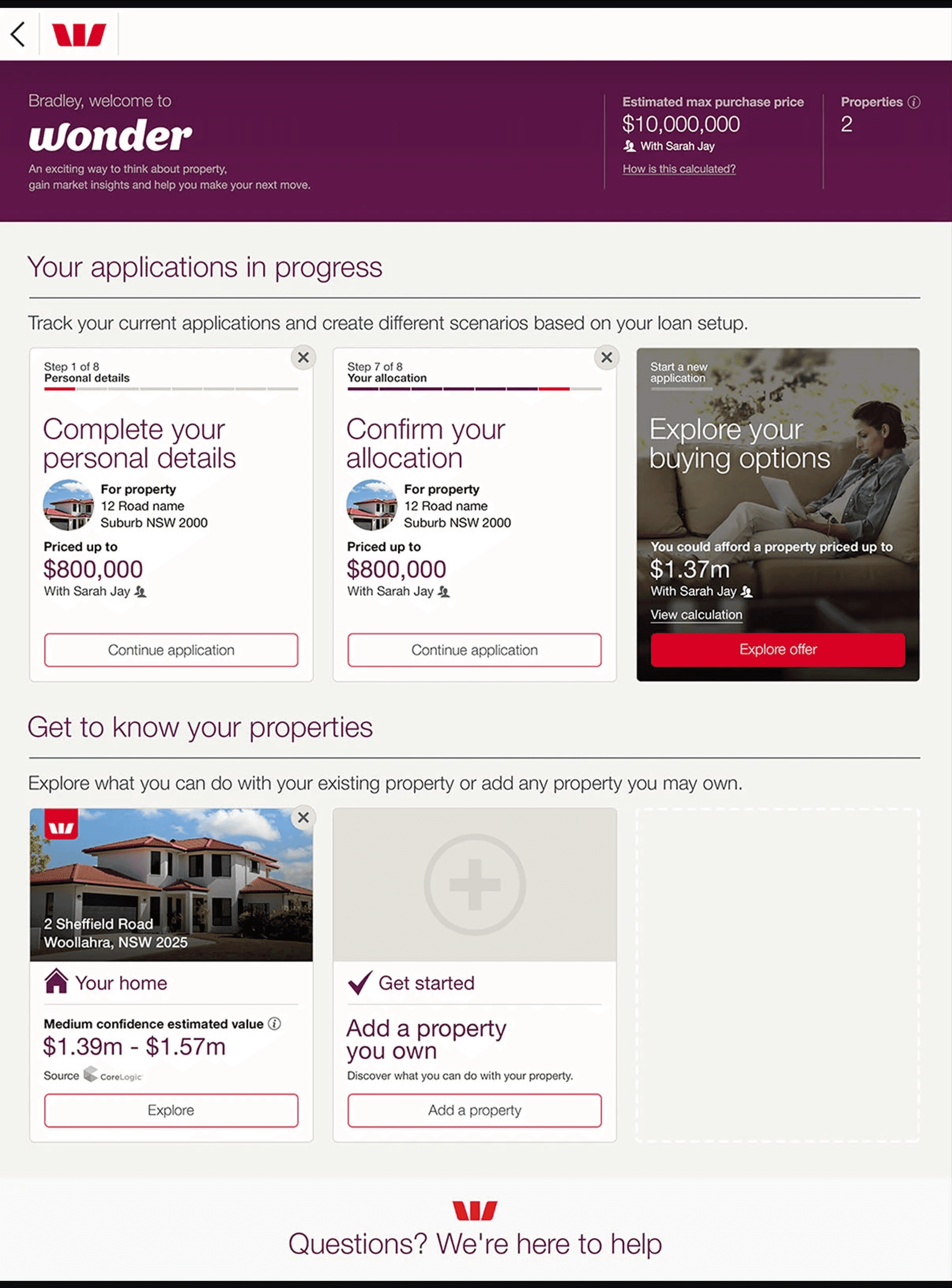

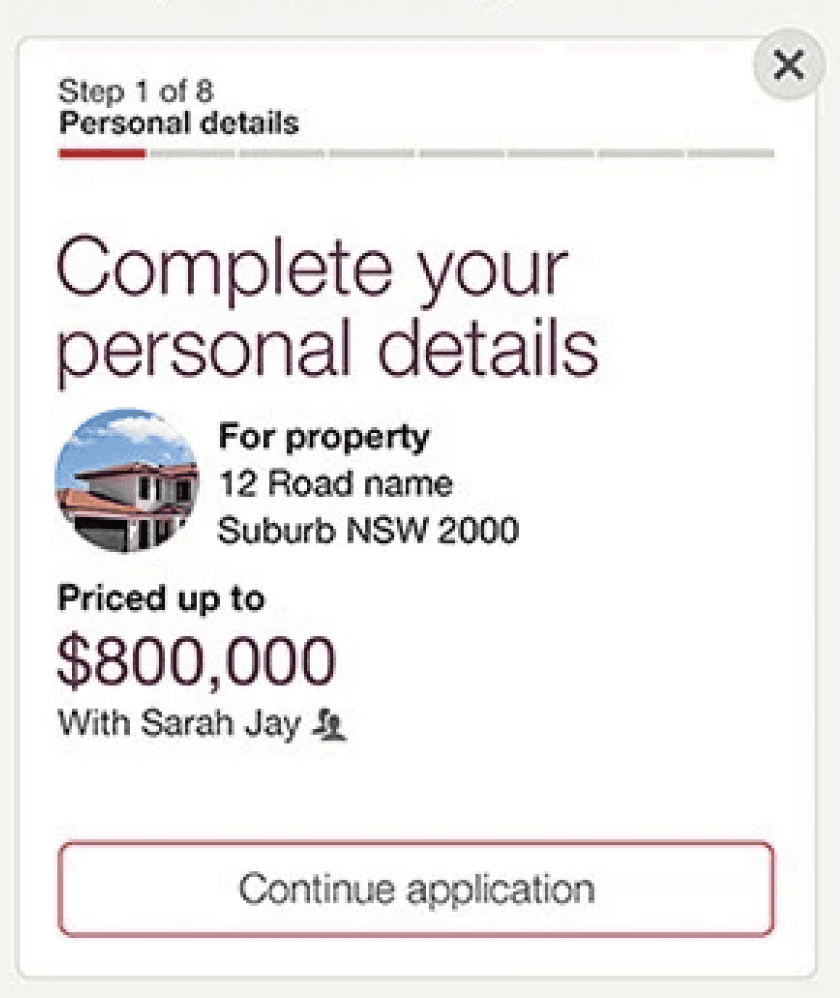

Westpac Wonder was an up-to-date customer profile connected to a real-time risk decision engine. It uses regulator-approved responsible lending practices to give customers a clear understanding of their borrowing options.

Each interaction with the bank — from a loan to a credit card — added to the customer’s profile. Which the risk engine would use to calculate a live lending figure, such as the principal amount a customer can borrow. As customers update information like salary changes or external credit cards, that lending figure adjusts instantly.

This approach replaces static calculators and repetitive forms with a living profile that reflects each customer’s financial position. It helped customers see exactly where they stand and what they can do next.

Problem

Before Wonder, every customer went through the same slow process — whether they were new to Westpac or long-term customers.

Step 1:

Fill out a paper form, which required lots of information that the bank already possessed.

Step 2:

Submit this form to a banker in branch, with supporting documentation such as proof of identity and assets.

Step 3:

Wait for a credit decision to be made, with fingers crossed that they received the outcome they wanted.

Customers

Customers felt uncertain and wanted transparent, timely guidance, due to the length of current process often meant being too slow for the market or the landlord.

Staff

Bankers were overloaded with manual tasks and had little time for relationship-building.

Approach

Aligned with stakeholders across Westpac to refine product scope and feasibility

Mapped journeys for three archetypes first-time buyers, renovators, and investors

Conducted user research to uncover pain points in the property journey

Created end to end flows for new home loans portion of Wonder.

Tested prototypes I designed with customers, iteratively on an almost weekly basis.

Worked with internals teams to ensure components were compliant for the GEL (global experience language)

Closely supported development team throughout delivery phase

Goals

Competitive differentiation: Build a property platform that gave Westpac an edge over rival banks, by positioning clarity and transparency as part of the value proposition.

Operational efficiency: Reduce branch staff time wasted on unqualified loan applicants.

Customer experience: Prevent negative experiences by helping people understand borrowing capacity upfront.

Outcomes

Customers could explore their options and at their own pace anywhere there was internet.

Joint customers could fill in their section at different times and locations.

Customers could verify their options and borrowing amount (including tailored pricing) based on their profile which made transparent data points that the bank used to make a decision.

For the first time get approval in principle online and instantly.

Outcomes

"Top ups" average days to receive funds down from 25 days to 3days, with many happening within 24hours.

17,000 onboarding completions to Wonder within 6 months

226 new loans created through the service

700 warm leads from customers who requested a call-back while they were completing the form.

We were not only the first bank in Australia but the word!

2016 - Retail Banking

Innovative

Mortgage

Product

WINNER

2016